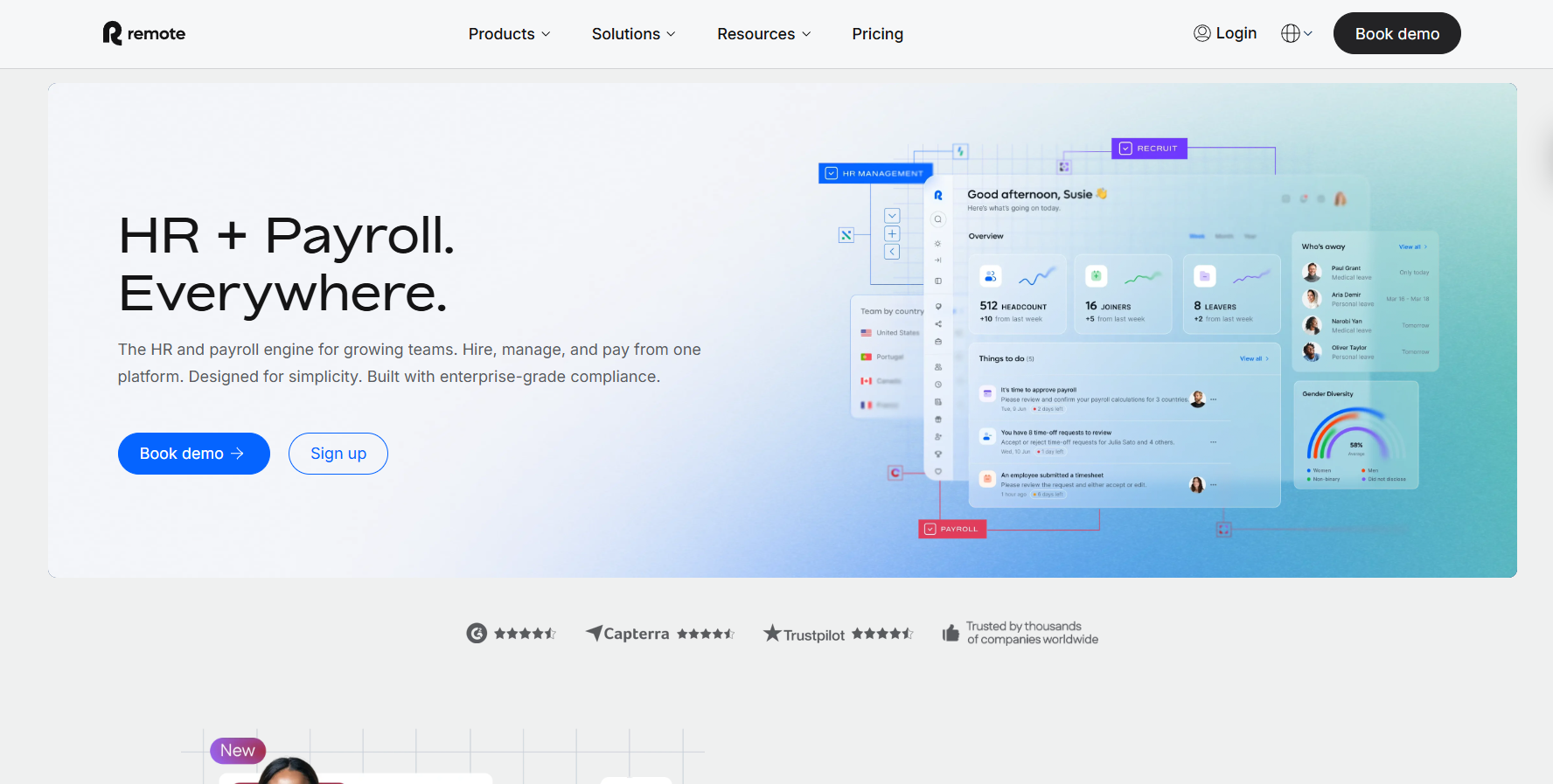

Remote.com - HR Management

A global HR and payroll platform built for distributed teams. It centralizes onboarding, HRIS, contracts, time tracking, time‑off/leave management, compliance, multi‑currency payroll, and worldwide payouts. Stripe is used for cards/ACH and recurring payments, while direct banking rails (ACH, SEPA, Faster Payments, SWIFT) are orchestrated for large cross‑border transfers—giving finance teams control, auditability, and compliance at scale.

Technologies Used

React.js

Express.js

MongoDB

TailwindCSS

Redis

AWS

Docker

What this platform is

An end‑to‑end HR management system for hiring, paying, and supporting remote employees and contractors across countries. It unifies HRIS, payroll, benefits, time tracking, time‑off policies, compliance, and payouts with country‑aware rules and automated workflows—so companies can scale globally without operational friction.

Global onboarding with KYC/KYB, e‑sign, and localized contract templates

HRIS with profiles, documents, policies, time & attendance, and approvals

Time tracking with timesheets, overtime rules, and approvals

Time‑off/leave management with policies, accruals, carryover, and holiday calendars

Contractor and Employer‑of‑Record (EOR) workflows with country coverage

Multi‑currency payroll (gross‑to‑net), stipend/bonus runs, and FX rate windows

Country‑specific tax rules, filings, and contribution calculations

Benefits administration and eligibility, localized by region

Role‑based access control (RBAC), audit logs, and granular permissions

Integrations for identity, accounting, and data pipelines (API & webhooks)

Before implementing Remote HR

HR and Finance teams juggled spreadsheets, bank portals, manual FX, and country‑specific calculators. Closing payroll introduced delays, errors, and compliance risk—especially for high‑value cross‑border payments. Contractors and employees were paid late; visibility and auditability were poor.

This platform replaces ad‑hoc processes with one system of record and automated global payroll. Stripe handles card/ACH collections and recurring billing; direct bank rails move large payouts with predictable fees and compliance guardrails.

Single source of truth for HR & payroll

Automated compliance and tax logic

Predictable FX and payout orchestration

Global visibility, audit logs, and controls

Key pillars of the system

A global HR and payroll backbone designed for remote teams—secure, compliant, and optimized for high‑value international payouts—with built‑in time tracking and leave management.

Global payroll & payouts: scheduled runs, off‑cycle, bonuses, reimbursements

Stripe for invoicing/ACH/cards; bank rails (ACH, SEPA, Faster Payments, SWIFT) for large transfers

Currency & FX: multi‑currency balances, rate windows, fee transparency

Compliance & tax: localized rules, filings support, and contribution logic

Time tracking: timesheets, overtime policies, approvals, and exports

Time‑off: policies, accruals, carryover, public holiday calendars, blackouts

EOR & contractor support: contracts, invoices, milestone approvals

Security & governance: RBAC, SSO, audit trails, and data residency options

How it works

A unified platform powering HR, payroll, and payouts. Data flows from onboarding to payroll runs and payment orchestration, with controls and auditability throughout.

01

Onboarding & KYC/KYB: localized contracts, identity checks, tax forms

02

HRIS & Documents: profiles, docs, policies, time & attendance

03

Payroll & FX Engine: gross‑to‑net, stipends, bonuses, and multi‑currency

04

Payout Orchestrator: Stripe for card/ACH; ACH/SEPA/SWIFT for large wires

05

Compliance & Reporting: tax logic, filings support, dashboards, and exports

06

Time Tracking: timesheets, approvals, overtime, and project/job costing

07

Time‑off: policies, accruals, carryover rules, and holiday calendars

Impact for People, Finance, and Legal

On‑time, accurate global payroll with fewer manual steps

Accurate time‑based payroll with compliant overtime and leave accruals

Reduced compliance risk through automated country rules and checks

Predictable FX fees and faster cross‑border settlement for high‑value payouts

Happier remote teams with clear visibility into pay and benefits

Finance ops time back via automation, approvals, and audit trails

Product Success